The State of the American Traveler in October 2023 -- Holiday Travel, Local Tourism Sentiment & the Ultimate Sign of Travel Loyalty

Perceptions of economic pressure and uncertainty continue to impact travelers’ mindsets, although travel enthusiasm remains at peak levels and a robust holiday travel season appears assured. Locally within communities, positive feelings about tourism are more common than negative, although age is a significant factor in this. Meanwhile, nearly one-in-ten American travelers reports they have a travel-related tattoo.

IMPORTANT: These findings are brought to you from our independent research, which is not sponsored, conducted, or influenced by any advertising or marketing agency. The key findings presented below represent data from over 4,000 American travelers collected in September 2023 by Future Partners (formerly Destination Analysts).

Read below for the latest on the impact of the economy, marketing to travelers, one of the ultimate loyalty behaviors in customer journey map, and community and local tourism sentiment.

The Economy & the Travel Outlook for the Holidays and Beyond

- As they have for the last several months, Americans are muted about their current financial situation but remain largely optimistic about the future. Affluent, urban and younger travelers are the driving force behind the overall sense of financial well-being.

- Perceptions of economic pressure or uncertainty continue to impact travelers’ mindsets. Optimism for increasing their trip volume in the next year is the lowest it has been in 10 months (currently at 27%; the high this year was 31% in February). At $3,711, anticipated annual travel budgets remain below the 2-year average of $4,024. In addition, there are more Americans who say the present is NOT a good time to spend on travel than those who say it is (38% vs 28%). However, Millennials are the generation most likely to feel now is a good time to spend; affluent and urban households are also more apt to spend on travel at present.

- Travel being too expensive has remained the top travel deterrent with 40% saying it has prevented them from traveling as much as they would have otherwise in the past 6 months and 32% saying inflation in consumer prices has led them to cancel an upcoming trip.

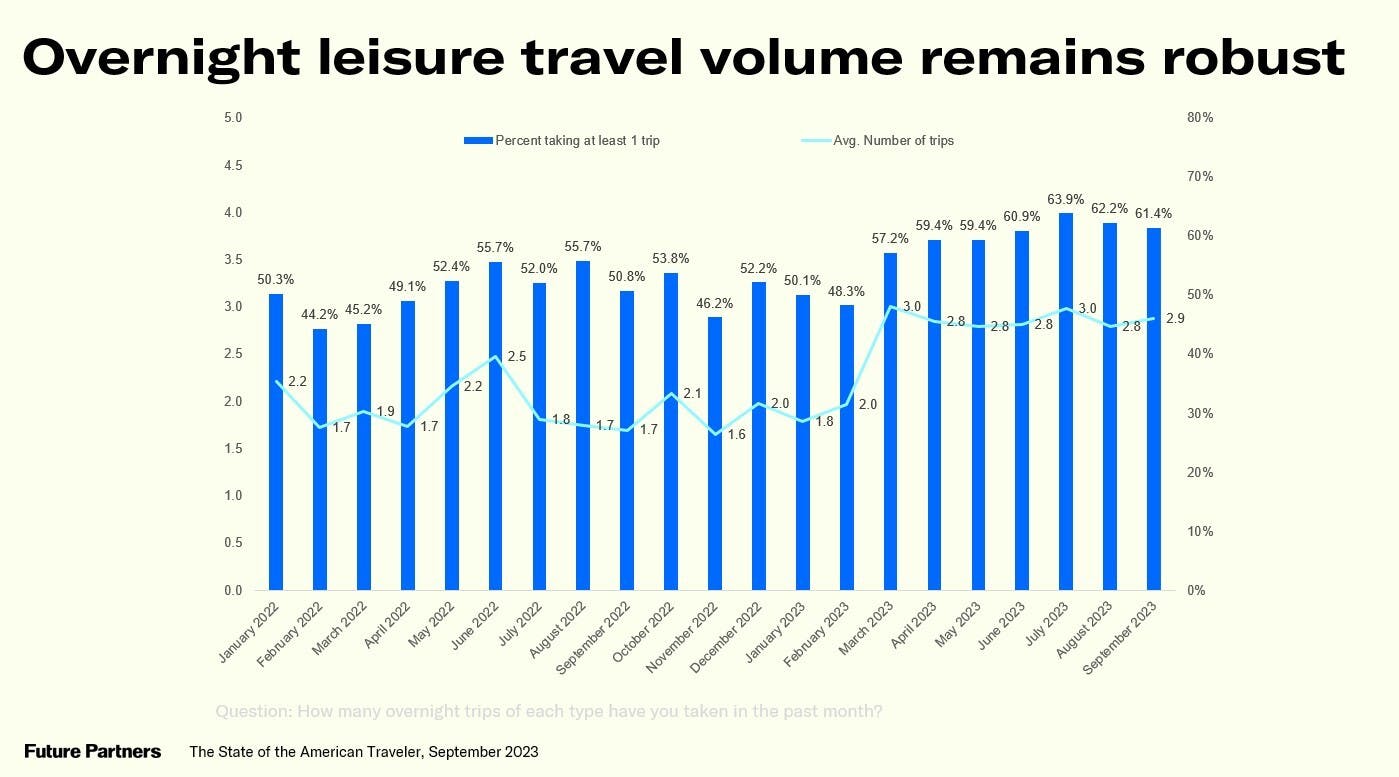

- The Future Travel Sentiment Index has been on the decline for the last 5 months but is still above where it was at the same point last year. The Current Travel Sentiment Index is not at the peak level seen in March of this year but is nevertheless strong. Just over 61% of American travelers took an overnight leisure trip in the past month.

- Enthusiasm for travel still remains at record highs (8.1 on a scale from 0-10, vs 7.3 at the same point last year). More than 87% of American travelers will take at least one leisure trip in the next 12 months—with over 81% having one or more of these trips already planned. The average American traveler anticipates taking 3.4 leisure trips in the next year. One-third say they will travel internationally over the course of the next 12 months.

- Thinking about the upcoming holiday season? Right now 26% of American travelers report they have a leisure trip planned for November and over 30% report trips planned for December.

Community and Local Tourism Sentiment

- Travel is often the inspiration for the decision to become a resident of a place. When asked to rate their agreement with the following statement, “I moved to my local community primarily because I visited and love the place,” 40% of American travelers agreed or strongly agreed. This notion is truest among the Millennial generation (43%) and Baby Boomers (42%). It is also notably higher among those residing in the Western U.S. (46%) and also skews to males, household incomes above $100k, urbanites, parents of school-aged children, and business and convention travelers.

- The most common reasons why people choose to move to their local community are proximity to friends/family, cost of living, and job/career opportunity, with the first factor increasing in importance with age, and the latter two factors of top importance to younger generations. Education, restaurants, and entertainment are also larger considerations for those. The Millennials and Boomers appear to be in agreement on the importance of a community’s landscape/natural features. Interestingly, 8% of Millennials said the political climate was a factor in their decision to live somewhere.

- When asked how satisfied they are with the direction their local community is headed, Millennials are actually the most satisfied (61.1%), while GenZ (39.2%) and GenX (49.0%) report the lowest levels of satisfaction.

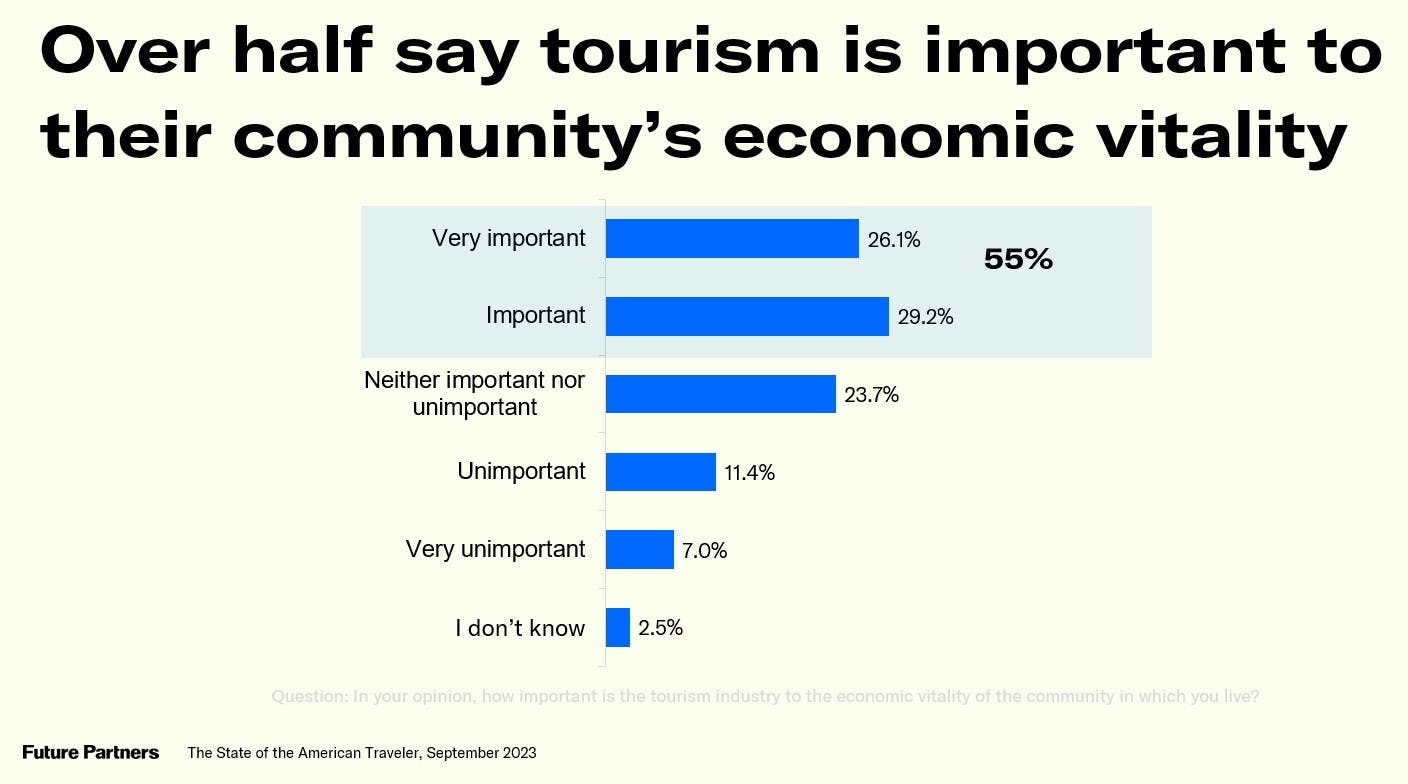

- About 46% of American travelers believe tourism in their community makes it a better place to live-- 37.3% are neutral, and 17% disagree. Those the likeliest to believe this include Millennial-age, high-income earners, more frequent travelers, business travelers, males, and those who reside in the Western US.

- Over 55% say tourism to the economic vitality of the community they live in. In fact, positive feelings about tourism are more common than negative. But age is a significant factor in feelings about tourism. Those GenZ age are less likely to see tourism’s connections to positive aspects of their community and they are the generation most worried about tourism destroying the local culture of the area.

- One in five American travelers identify as living in an area that is “over touristed.” If they feel this way, it is likelier than not that they perceive this as a big deal. Nearly half (48%) say it is a serious or extremely serious problem. In addition, if a U.S. destination has a perceived problem with “overtourism”, 52% of American travelers say they are less likely to visit it. However, younger travelers are less sensitive to this relative to Boomers (60% of them feel this way).

Marketing Travel

- Making good on their travel enthusiasm, about 80% of American travelers have done some travel dreaming and planning in the last week alone, with 14% actually booking/purchasing.

- In terms of top resources for travel inspiration, search engine marketing, and email campaigns continue to be particularly effective for reaching GenX and Boomer-aged travelers, while Millennial and GenZ travelers cite Facebook, Instagram, and Tiktok as where they are most receptive.

- Travel booking windows continue to shrink with the typical American traveler now saying they would plan a week-long vacation just 10 weeks out (down from over 12 weeks reported at the same time last year) and that they planned their last overnight trip just 6.2 weeks before they traveled.

Travel Tattoos—One of the Ultimate Signs of Loyalty

- Some recent work helping clients with customer journey mapping has us thinking a lot about the loyalty stage in travel… what more notable sign of commitment than a tattoo? So we asked the travelers we surveyed this month if they have ever received a tattoo(s) specifically to commemorate, celebrate, or dream about a travel experience, and we found that almost one in ten indeed have.

- We followed up with an open-ended question of those with travel-related tattoos about which place or destination they have inked. More than half are destination tattoos, with New York and Hawaii taking the top spots of the most common reported.

For the complete set of findings, including historic data and custom information on your destination or business, purchase a subscription to The State of the American Traveler study.

Learn more about the latest trends during our monthly livestream.

To make sure you receive notifications of our latest findings, you can sign up here.

Have a travel-related question idea or topic you would like to suggest we study? Let us know!

We can help you with the insights your tourism strategy needs, from audience analysis to brand health to economic impact. Please check out our full set of market research and consulting services here.